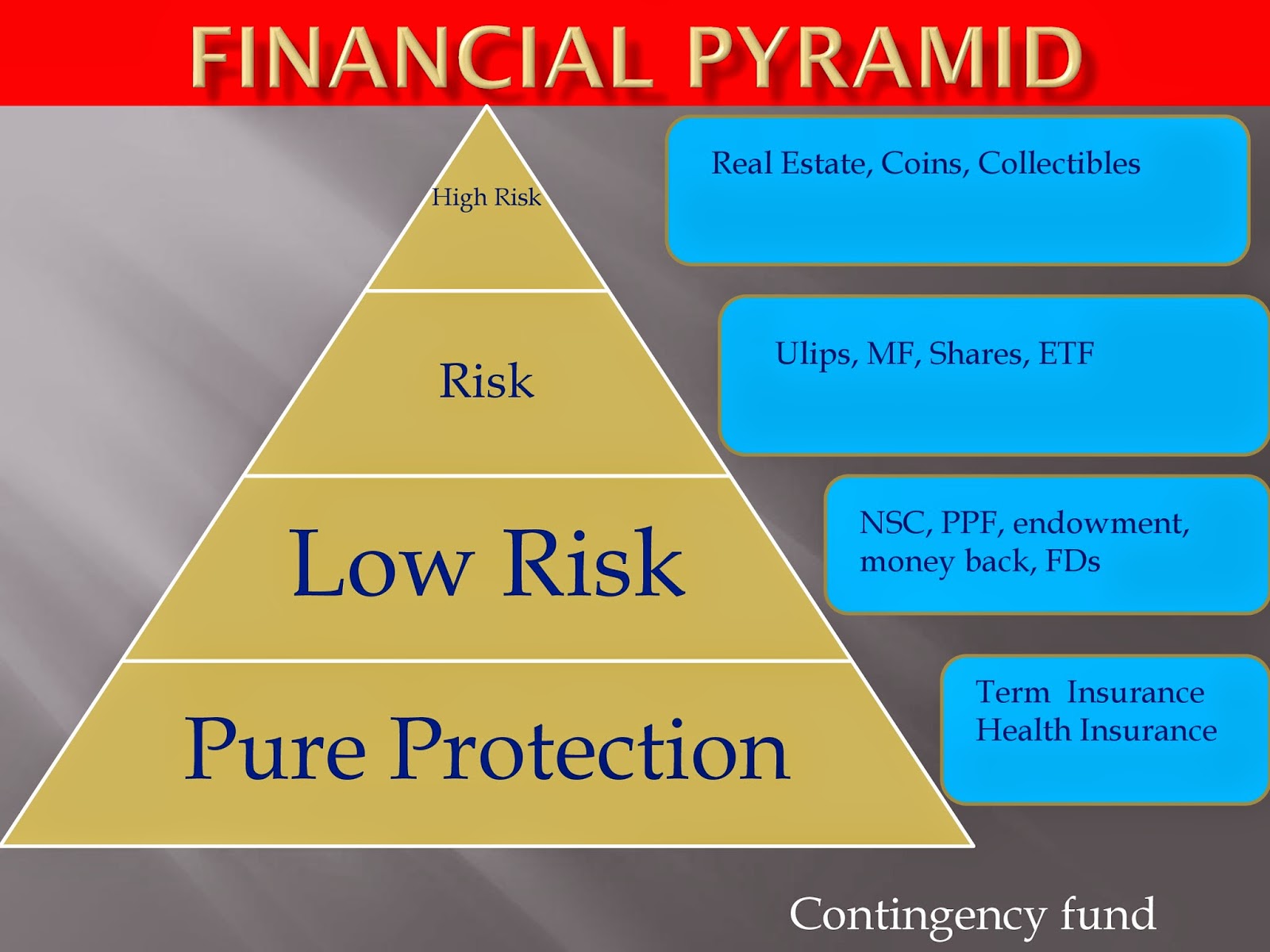

Having understood the importance of insurance, the question arises as to how much of insurance does one need and where does it fit into the financial planning. To make matters worse you have a whole lot of insurance products being pushed by agents of all insurance companies. You have the endowment policies, money back policies, Ulips and also the term insurance. Very few Life insurance agents actually promote the term insurance , which gives pure protection. Term insurance gives a lump sum to the nominee on the death of the person who has taken insurance. There is no maturity benefit in this product…

As we all know that

for any building to be strong, it should have a strong foundation. In exactly

the same manner for any financial planning to be stable and robust, the base

should be made up of term insurance and

health insurance. This can be anything between 5-7% of the total investments.

After protecting the family and dependents ,

in the next stage , your investments can be in less risky instruments

like, endowments, NSC, PPF, FDs etc.

These investments can take about 10-15% of your investments. The returns

here are low but are fairly stable.

In the next stage

more risky instruments like Ulips, MFs, shares can be a part of our planning.

It is also essential to have at least 6 times of monthly

expenses as a contingency fund in liquid form

for unforeseen emergencies…

We will go into all the aspects in detail in the

subsequent weeks…